Lincoln Minerals zeroes in on high-priority SA uranium targets

- James Pearson

- Dec 18, 2024

- 3 min read

Lincoln Minerals (ASX: LML) has zeroed in on several high-priority uranium targets after successfully completing initial fieldwork at its Yallunda project on South Australia’s Eyre Peninsula, 15km northwest of Tumby Bay.

The company says preliminary visuals have shown strong signs of uranium mineralisation, with promising anomalies suggesting there could be considerable untapped potential lurking beneath.

The soil sampling campaign, conducted across three key tenements returned 48 samples from a 7-kilometre-long surface uranium anomaly which had been picked up in previous geophysical surveys in 2011.

Importantly for the integrity of the exploration program, the project area already includes the Carinya uranium prospect, first discovered in 1980 by Afmeco. Its work found surface uranium mineralisation linked to a rock type called the Miltalie Gneiss. Later trenching in the area confirmed the presence of uranium.

A subsequent drilling program by Afmeco in 1982 delivered further encouraging results, including up to 350 parts per million (ppm) uranium from 52m.

The ground then remained untouched until 2002 when Centrex, chasing iron ore, picked up 260ppm uranium from 63m while mapping completed by Lincoln in 2009 - using a portable Niton XRF analyser - picked up surface samples with grades as high as 10,800 ppm uranium.

The wider region is made up of ancient rock formations, known as the Hutchison and Middleback Groups, along with igneous intrusions from the Moody Suite. The company’s tenements also lie along the Kalinjala shear zone, a significant geological feature on the eastern edge of the Eyre Peninsula which is also home to two of Lincoln’s other projects it is actively developing, a one billion tonne magnetite deposit and its Kookaburra graphite project.

Once the results of the survey are back from the assay lab next month and depending on the results, the company plans a second phase of sampling early next year to refine targets further ahead of a proposed drilling campaign by mid-2025.

The early observations are highly encouraging, and we are eager to advance this project to be drill ready. Lincoln Minerals remains focused on delivering value with an expectation that the growing prospectivity of our Uranium portfolio will lead to a successful outcome for the third-party funding process that has commenced and is due for completion in early 2025.

Lincoln Minerals CEO Jonathon Trewartha

As part of the expanded exploration program, the company also announced earlier in the week it had secured an additional and virtually unexplored mineral exploration licence within the Yallunda prospect area, filling a gap in between leases and ensuring the entire project remains contiguous.

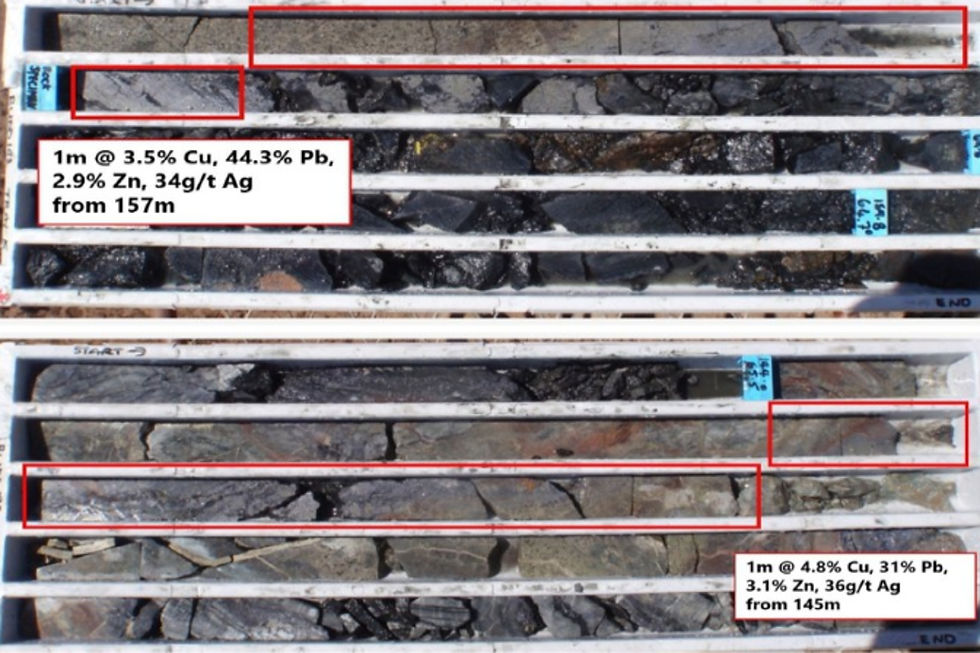

The company says the new ground is a prime target for future exploration. Notwithstanding the lack of previous drilling, the tenement is surrounded by promising mineral finds. To the east, within another of Lincoln’s leases, several historic copper mines and base metal prospects have been recorded, while the magnetic trend running through the new block lines up with known copper-lead-zinc mineralisation to the southwest and iron ore deposits to the northeast.

As Lincoln sets its sights on the next phase of fieldwork at Yallunda, it is also in the planning stages of a new round of exploration on the company’s Minbrie prospect within its broader Eyre Peninsula ground, expected to kick off in the first half of next year.

The follow-up work at Minbrie will build on Lincoln’s recent analysis of drilling data from a 2011 exploration hole originally conducted by Centrex Metals in search of magnetite.

Although the core was assayed at the time and no iron ore was identified, Lincoln’s recent re-examination of the samples unearthed a remarkable 29.5-metre intercept, grading 0.8 per cent copper, 7.4 per cent lead, 1.9 per cent zinc and 9 grams per tonne (g/t) silver including a standout section of 12m running 1.4 per cent copper, 12.4 per cent lead, 2 per cent zinc and 13g/t silver.

Management says the early promising exploration signs at its Yallunda uranium project have strengthened Lincoln’s potential to secure third-party funding, with discussions already under way. If the results are as good as the early signs suggest, the company has said it will explore various options, including a partial sell-down, strategic divestment, or even a full sale of the project to help manage the overall funding of all its projects.

With assay results imminent and a second phase of sampling on the way, Lincoln is gearing up for what could be a pivotal year. If upcoming exploration confirms the potential of the Yallunda project, it could draw significant industry interest and funding. Meanwhile, continued success at the Minbrie copper-lead-zinc-silver target, following the recent standout discovery, has the potential to be a game-changer for the company.

Is your ASX-listed company doing something interesting? Contact: office@bullsnbears.com.au