Bright lights of Saudi Arabia attract Surefire Resources attention

- Craig Nolan

- Jun 7, 2024

- 7 min read

The bright lights of a future Saudi Arabia are enticing Australian companies such as Surefire Resources (ASX: SRN) to the Arabian Peninsula – and the company is looking to supply the minerals that will be needed to build the Kingdom’s pipeline of significant projects planned for the coming decades.

And whetting management’s appetite is the fact that the super-wealthy country has acknowledged it needs help from “experienced mining heads” to help develop its fledgling industry. While there have been some significant bumps in the road for the nation’s bold vision – particularly with extraordinary projects such as the US1.5 trillion (AU$2.3 trillion) housing gigaproject “The Line” being pared back – its penchant for progress has not been diminished.

The Kingdom of Saudi Arabia (KSA) has outlined a mission to establish “cities of the future”, with an impressive mix of high-tech modern communities and is offering impressive incentives for companies thinking about doing business there. One major carrot the KSA has dangled is its promise to provide up to 75 per cent of the capital expenditure required for a company to bring a mineral processing project into operation.

It is a low-cost power and fuel jurisdiction and has a significant steel sector, with a need for vanadium oxide.

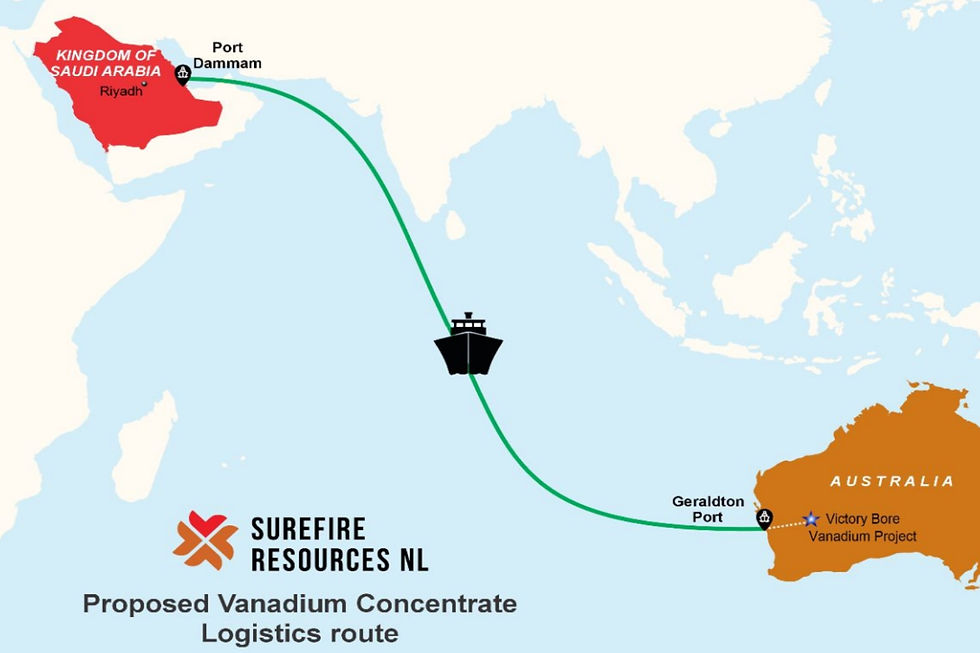

Surefire recently signed memorandums of understanding (MOU) with the KSA Ministry of Investment (MISA) and two private Saudi companies. The MOUs have been put in place with a view to completing binding agreements for a joint venture (JV) structure that will establish a framework for investment into Surefire’s flagship Victory Bore vanadium-iron project. It will have a dual purpose of also developing a mineral processing facility in Saudi Arabia to process magnetite concentrate from the company’s Victory Bore operation in Western Australia’s Mid West region.

If the JV proceeds and the projects are developed, the companies will each have up to a 50 per cent share in both operations. As of today, negotiations nutting out the detail of the JV are ongoing.

The MOU with MISA also provides Surefire with a range of assistance measures, including finding suitable land for processing facilities, introducing the company to potential partners and assisting with nailing down binding finance and development agreements. Management’s objective is to mine the ore from Victory Bore and beneficiate it to produce a clean magnetite iron concentrate, then ship it to the KSA to benefit from lower operational and capital costs for the downstream processing.

Victory Bore has a mineral resource of 464 million tonnes at 0.3 per cent vanadium oxide, 5.12 per cent titanium oxide and magnetite iron going 17.7 per cent. It boasts a reserve of 93 million tonnes at marginally-higher grades and a concentrate grade of 1.43 per cent vanadium oxide.

Surefire plans to produce 1.25 million tonnes per annum of a vanadium-titanium magnetite concentrate from the project and by using a downstream process, convert the upgraded ore into a myriad of in-demand products.

The beneficiation process is expected to upgrade the material from its in-ground value to about 1.43 per cent vanadium and a higher-grade magnetite concentrate. It is aimed at improving both its attraction to interested parties and the potential to produce a ferro-vanadium product, titanium slag, pig-iron, high-grade iron ore, a high-purity iron oxide pigment grading 99.9 per cent and importantly, vanadium electrolyte.

The vanadium grade after the concentration process is the most important aspect – not the in-ground grade – and that is often overlooked. And the company says its ore responds well to the beneficiation process, with the grade increasing more than three-fold and recoveries exceeding 90 per cent.

An added “free kick” is the fact that the vanadium is contained within the magnetite ore and not found in ilmenite – which is not present in the resource – unlike the material of many of its competitors. Interestingly, Surefire also says it has fielded several enquiries about its potential vanadium electrolyte product that appears to be in-demand.

Victory Bore is emerging as “the gift that keeps on giving” as it also contains a zone of high-grade aluminium that sits between two magnetite zones at the project. The company says a 37 million-tonne resource has been estimated at a grade of 25 per cent, providing it with a further opportunity to produce high-purity alumina (HPA).

Management says the HPA feedstock could also be processed in the KSA where demand for the product is increasing, or it could export it to Europe where demand is high. But for now, the focus is very much on the vanadium and iron possibilities.

Surefire has also developed a new mineral recovery process that has improved extraction levels of metals up to 97 per cent. The process is now under a provisional patent application with IP Australia, an Australian Government agency responsible for administering intellectual property law, to protect the company’s interest in the technology.

Intriguingly, the process removes the use of a rotary kiln, usually a large structure that is heated to 1100 degrees Celsius by gas or coal-fired power. The technology could be of immense interest to the vanadium industry if it is proven to work on a commercial scale, in addition to improving Surefire’s “green-credentials”.

The patent provides the company with 12 months to fine-tune the process before deciding to file a full-patent application.

A recent preliminary feasibility study (PFS) for Victory Bore released in December last year revealed a robust internal rate of return (IRR) of 42 per cent and a pre-tax net present value (NPV) of $1.1 billion using a 10 per cent discount rate, with a capital cost of $498 million and a payback period of 2.4 years. The expected mine life is 24 years.

The company also has its Perenjori magnetite project, which would fit beautifully into any such proposal for exporting ore to the KSA. The project contains a mineral resource of 191.7 million tonnes at 36.61 per cent iron ore, with a whopping exploration target of some 870 million tonnes to 1.24 billion tonnes at a grade between 29 per cent and 41 per cent.

Management believes the ore could be beneficiated to about 50 per cent, then shipped to the KSA to be converted into “green steel” with a grade of 70 per cent iron. There could be serious dollars at play if it could export the quantity of ore its exploration target is aiming at.

Surefire also has its promising Yidby gold project that has produced hits of up to 82 grams per tonne, with a 3km strike length that remains open at depth and along strike.

The KSA is the fifth-biggest country in Asia, based on a land area of 2.15 million square kilometres and its leaders are intent on making it become an enviable place to live in the future.

Visionary projects such as NEOM, which is essentially a special economic zone described as a “city of the future”, are aiming to offer the world’s highest standards of liveability. It is based on a premise of improvement to how we live on the planet and how we interact with nature.

NEOM is an ambitious development covering a whopping 26,500sq km in the north-western region of Saudi Arabia, at the northern tip of the Red Sea. It will provide 100 per cent renewable energy and sustainable water to residents and businesses.

In a reflection of the futuristic city’s disdain for waste, it even plans to use the salt it desalinates from the water. The plan contains 10 different zones, with its biggest and most well-known being The Line – designed as a community module where all services will be within a five-minute walk.

The Line has been designed to have no cars or roads, with the entire city to be contained within two parallel, 500m-high linear skyscrapers standing 200m apart. Both structures will be clad with mirrored facades.

Another zone is the Oxagon, a floating port city that will connect with ships travelling through the Suez Canal. It will be located partly on land, with a floating structure protruding into the sea.

When completed, the off-shore section will supposedly be the world’s biggest floating structure.

There have been some significant teething problems with getting The Line out to its envisaged massive scale, but the project is continuing.

The KSA has revealed a Saudi Green Initiative (SGI), an ambitious national strategy focused on combating climate change and protecting the environment for future generations. It is seeking to accelerate the country’s transition to a green economy.

Launched in 2021, its ambition is to reach net-zero emissions by 2060.

Part of its renewable energy push involves vanadium redox flow batteries (VRFB) because of the product’s ability to provide scalable, long-life and safe electricity storage.

The World Bank Group (WBG) recently released a report noting that with time, the demand for large volumes of stored energy will increase as a consequence of wind and solar photovoltaic power capacity development. It expects that VRFBs will provide an adequate long-duration energy storage solution in cases where large-pump hydropower is not feasible and other grid investments are too costly.

The global vanadium market is dominated by steel and other metal production, with battery storage demand accounting for just 2 per cent of total consumption. However, the WBG believes battery storage demand is likely to increase rapidly in the next decade, reaching 10 per cent of total demand by 2030 and putting pressure on vanadium prices.

To meet the growing demand, the global vanadium supply will need to increase by about 6.9 per cent per year between now and 2030.

With the increasing demand for stationary energy storage, the global investments made in the sector are expected to continue at a rapid pace and reach more than US$30 billion ($AU45 billion) by 2030. The huge market for stationary applications is anticipated to have a bigger share of grid-level storage by the end of the decade and is expected to be dominated by lithium-ion batteries.

However, it will also create huge market potential for VRFBs in the future, as the batteries have superior performance in the grid and other long-duration stationary storage applications when compared to lithium-ion batteries.

VRFBs discharge at 100 per cent throughout their lifetime, where lithium-ion batteries decay and lose capacity over time. They can also operate at a wide temperature range without any adverse effects in performance.

Lithium-ion batteries have inherent safety risks due to overheating and thermal runaway, while VRFBs are non-flammable, non-toxic and have no explosion risk. They also typically have a much longer lifespan and Surefire appears well-placed to supply the vanadium needed to help build the VRFB industry.

So, the company’s vast quantities of minerals could be just what the KSA is looking for as it transforms itself into a country with cities that may become the envy of all other modern nations.

Is your ASX-listed company doing something interesting? Contact: office@bullsnbears.com.au